IAG Cargo and Seabury report on busy airfreight market

April 13, 2021 by Choice Aviation Services0Air CargoAirlinesDataSupply ChainsTop Story

IAG Cargo has described the airfreight market as “incredibly busy” with particularly strong growth in e-commerce and automotive sectors, as well as the rollout of Covid vaccines.

At the carrier's Cargo Live webinar, chief commercial officer John Cheetham at IAG Cargo, said that the company is continuing to expand its network which is helping to support the increase in e-commerce demand seen last year when the pandemic hit.

“Our regular flying schedule, cargo-only and passenger bellyhold, continues to expand,” said Cheetham. “We're working very hard to make sure that we have a truly global network available. We're increasing in frequencies form south Asia — Bombay and Delhi — and also increased frequency from Johannesburg.”

He added that demand for IAG Cargo's air cargo charter service remains high.

“We're fortunate — we have access to all the fleets of British Airways, Iberia, Aer Lingus and Level, and we're able to draw on that fleet and provide charter capacity as and when required,” he said. “We've seen a huge amount of demand for that, particularly in the automotive industry, but also in other industries as well.”

IAG Cargo chief commercial officer John Cheetham

In addition, the carrier is continuing to support the rollout of Covid-19 vaccines and it has already delivered millions of doses, using its Constant Climate pharma service, to destinations across its network.

“I'm proud — and so is my team — that we were able to do our little bit to help fight the virus,” said Cheetham. “It's very important and close to all our hearts.”

This month, IAG Cargo also celebrated 10 years of operations since its establishment in 2011.

Jonathan Mellink, commercial manager at Accenture's Seabury Cargo, provided an air cargo market update during the event.

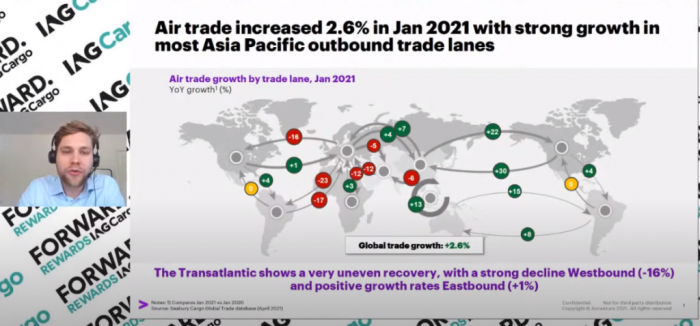

He revealed that global air cargo demand increased by 2.6% year on year in January 2021. However, this 2.6% is not distributed evenly across the industry's trade lanes.

He noted that airfreight volumes on the transpacific lane, both on the eastbound and westbound, were very strong. Similar trends were seen on intra-Asia trade lanes.

However, Mellink said, recovery on the transatlantic trade lane is imbalanced.

He explained: “On the transatlantic lane, the performance westbound was not great and we can still see a big difference in [demand according to the] industries.

“When we look westbound, from Europe to the US, we can see good growth in automotive — 4,000 tonnes of additional volumes on top of those from last year. This is because there is large demand from Germany, Italy and the UK for car parts. So the automotive industry has really pushed up demand on this route westbound.

“On the same westbound route, there was a decrease in volumes for raw materials and perishables. In raw materials, we saw significantly lower volumes out of France, Italy and the UK. We also saw a decrease in fresh salmon exported from Norway.”

The transatlantic lane eastbound showed a “a completely different dynamic”, with demand differing more widely for each industry.

For example, eastbound from the US to Europe, there was a decrease in volumes for aerospace equipment and medical machinery. Meanwhile, there was an increase in volumes of organic chemicals into the UK and Germany. There was also an increase in raw materials volumes including foodstuffs.

“Overall, the eastbound transatlantic route performed strongly for specific industries,” said Mellink. “And the westbound route has not quite recovered from the hit it took in 2020 due to covid.”

The post IAG Cargo and Seabury report on busy airfreight market appeared first on Air Cargo News.